The future is now!

We offer a broad range of fintech solutions

Together with our bespoke technology, we curated some of the best fintechs in the world for our VODENO Cloud Platform. Nearly 90 partners – and growing – are integrated into the platform to offer end-to-end embedded banking solutions across accounts/onboarding, payments, cards, investments, lending and much more.

Comprehensive Banking-as-a-Service

The VODENO Cloud Platform is one of the most comprehensive Retail & SME banking platforms on the market. We support, among many others, some of the most sought after solutions, including Buy Now Pay Later (BNPL), decoupled debit, merchant financing and accessing payment infrastructure. Tell us your vision, and we will advise on the best solution for your business.

Cloud-Native Platform

We are the first banking platform built on Google Cloud architecture. As a certified Google Partner, we have been tested to be scalable and agile in handling large transactional volumes through the VODENO Cloud Platform’s suite of APIs.

Full ECB banking licence

Get a BaaS solution from an actual bank. We hold a full ECB licence for all key EU markets, and we provide the broadest portfolio of banking products and services coupled with the guarantee of a licensed European bank. That way, you can be sure the products you offer are fully compliant with the latest regulations.

Comprehensive Suite of Embedded

Banking Products

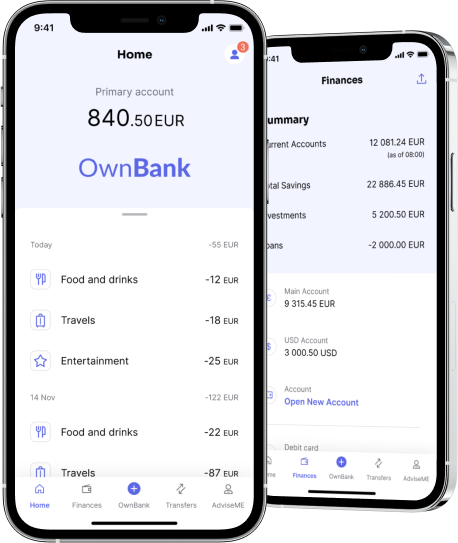

Current Account:

Fully enabled accounts with local IBANs (for BE, DE, PL and SWE) allowing storage of funds in multiple currencies, as well as an enabler for payments and cards. All deposits covered up to €100,000 through Belgium's deposit guarantee via Aion Bank’s full ECB banking licence.

Current Account:

Fully enabled accounts with local IBANs (for BE, DE, PL and SWE) allowing storage of funds in multiple currencies, as well as an enabler for payments and cards. All deposits covered up to €100,000 through Belgium's deposit guarantee via Aion Bank’s full ECB banking licence.

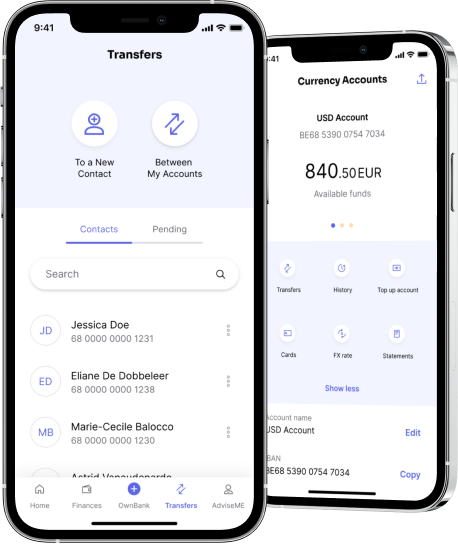

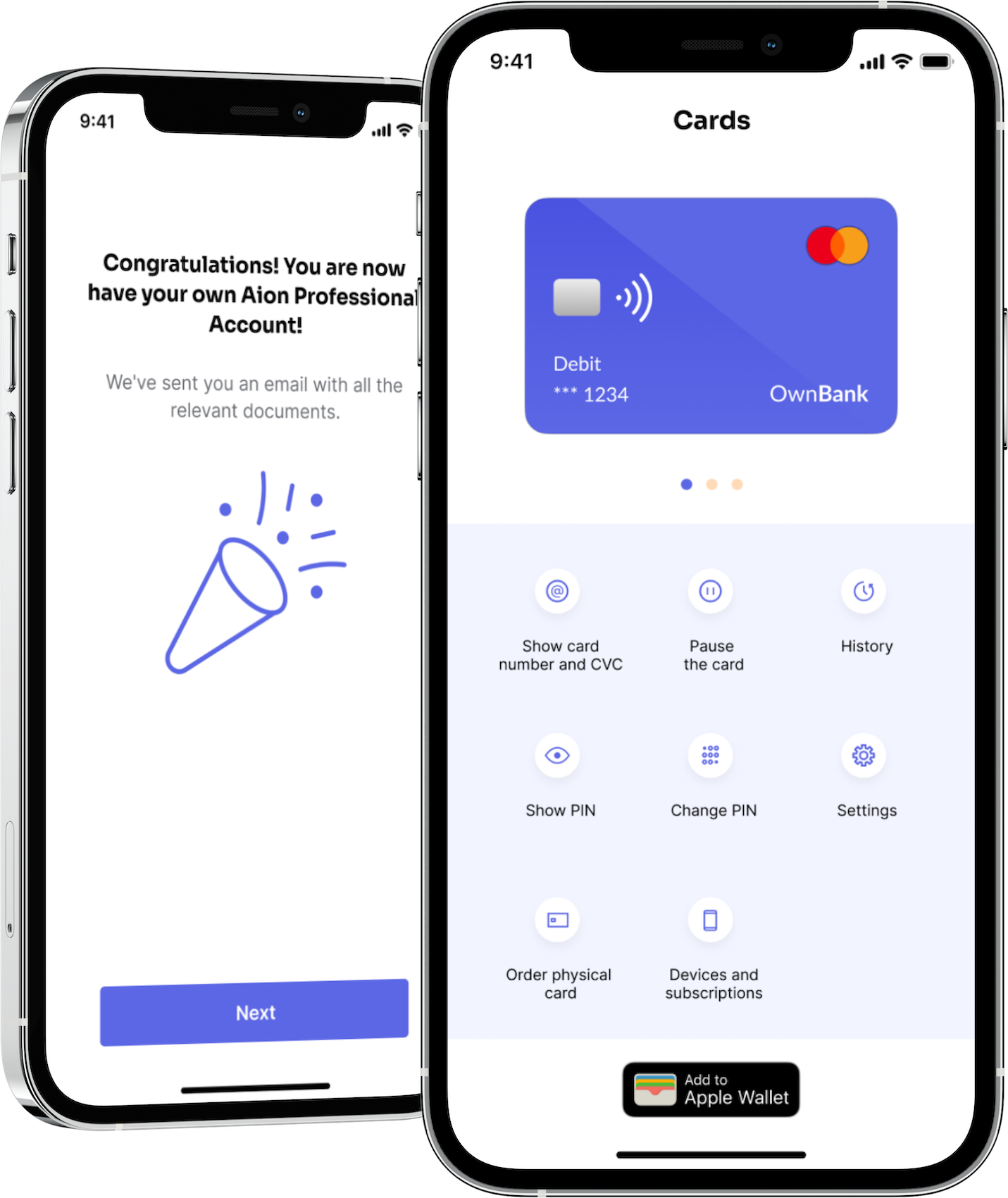

Cards:

Instantly issued digital debit & credit cards (with plastic ordering option), as well as Apple and Google Pay tokenisation, NFC Contactless payments, and 3D Secure with biometric authentication.

Payments:

Direct membership in payment schemes: Mastercard, Visa, SWIFT, EBA clearing for SEPA payments to support European and international payments and local schemes in Poland and Sweden.

Digital onboarding:

Full financial onboarding that can be seamlessly embedded into existing customer journeys supported with SDK and dedicated endpoints; available both for retail and business customers in multiple geographies.

Banking Back-office:

AML / Compliance, Reporting, Monitoring and Fraud prevention are all included in our offering.

Easy integration:

Single API integration: start in no time; get all products without the need to integrate with multiple vendors.

Savings Accounts:

Saving accounts and term deposits are available in multiple currencies; all deposits covered up to €100,000 through Belgium's deposit guarantee through Aion Bank’s full ECB banking licence.

Virtual IBANs:

Virtual accounts unlock access to new territories and multiple currencies by providing an option for end-users to receive payments to unique addressable IBANs via local and cross-border payment rails.

Multi-currency Settlement Account:

We offer a multi-currency account with no currency conversion fees; for settlement, we support the following:

- Deposit funds

- Support for incoming payments

- Initiate outgoing payments

Payments for EUR, international and local currency

Access to:

- SEPA Credit Transfer

- SEPA Instant

- SEPA Direct Debit

- SWIFT

- Local payments

Local payment schemes: Branch licences in PL and SE give access to:

- Elixir (PL)

- Elixir Express (PL)

- Giro (SE)

Local mobile payment schemes:Branch licence in PL gives access to:

- Blik (PL)

BNPL:

Offered as:

- One of your payment methods with direct product plugin in your shop/portal

- Unique combination of two products within one solution: 1) Deferred (Delay) Payment; 2) Instalment Loan - split payment into two to 24 instalments

- Local integrations with credit registers and PSD2 providers

Cash loan:

Full spectrum of cash loan features:

- Classic consumer loan with fixed monthly instalment schedule and flexible early repayment possibilities

- Fully digital application: online verification of customer data, eligibility check, automated scoring, digital contract signing and online money dispatch to customer account

- Compliant with the local market requirements

Decoupled debit card:

Branded debit card linked to the user's current account of choice, no need to open a new account or top-up funds to the card:

- Fully digital process: customer onboarding, identification, automated basic risk-checks, limit opening and after-sale services

- Small credit limit to pre-fund payment from decoupled card

- Flexible repayment method at maturity

Merchant financing:

Lending solution that perfectly suits the SME retail model, offers up-front capital that can be used to produce or buy goods, with repayments drawn from the revenues of those goods once they are sold.

Salary advance:

Provides employees with access to earnings before payday:

- Credit product allows employers to offer their employees and contractors instant access to earnings from the current period, before payday

- Automatic repayment from the next pay period

- Flexible repayments adapted to the salary payment cycle

Fully API-based solution:

- Full flexibility for product features: interest, penalties, loan duration, etc.

- A broad suite of payment methods available

- Fully digital and paperless process: online verification of customer data, eligibility check, automated scoring, digital contract signing, instant money dispatch if approved

- Easily white-labelled

- Retention of data

The Future of Financial Services

Smart brands understand the value of embedded banking. Customers enjoy a seamless checkout experience, and businesses see an increase in conversion, repeat visits, and brand loyalty. Embedded lending is just one way that Banking-as-a-Service (BaaS) is changing the way people shop and buy. Learn how the lending space is being powered by BaaS.

Services

Customer facing services

Daily banking services

iOS, Android and web apps

Vivamus elementum semper nisi. Phasellus consectetuer vestibulum elit. Proin viverra, ligula sit amet ultrices.

Customer support

Customer communication

Daily banking services

Digital onboarding

Accounts

Lending and BNPL

Payments

Cards

Savings and investments

Business processes outsourcing

White-label mobile app

Other services

KYC/AML/AF management

Credit risk management

Data and reporting

???

Foreign Exchange

Treasury

???

Cloud engineering

???

Revolutionise the market with an innovative banking app

Aion Bank was the first European bank to be built entirely with cloud technologies, and you can access this revolutionary banking app through our white-label service.

This app offers a full suite of services without needing to visit a branch, including onboarding, loan applications, and business banking.

Payments

Access a whole host of local, instant and international payments

Merchant financing

Optimise your cashflow for accelerated growth and innovation

Decoupled debit

Leverage the power of Open Banking to create unique customer experiences

Get in touch to schedule a demo of our Platform in action.

- See the full suite of financial services you can offer

- Learn how Banking-as-a-Service can support your business

- Learn what a Banking-as-a-Service project looks like