In the face of heightened competition and changing market conditions, how consumers can access banking products is driving a new wave of innovation across the financial services sector.

Banking-as-a-Service (BaaS) providers are making it possible for different businesses to offer financial services directly to their customers, and as a result, banks are partnering with fintechs to capitalise on the BaaS opportunity.

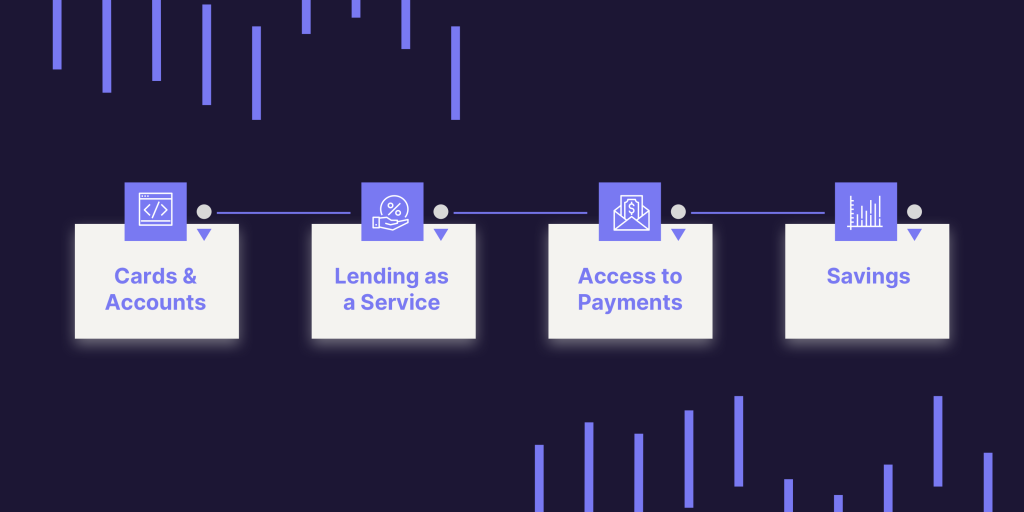

At Vodeno, we built our cutting-edge, cloud-native platform – the Vodeno Cloud Platform (VCP) – to help usher in a new financial services ecosystem. VCP is fully API-based, built with proprietary blockchain technology and can provision a comprehensive suite of banking services based on a partner’s banking licence, including: smart contract enabled core banking, accounts, onboarding, payments, cards and lending solutions.

Our technology is able to seamlessly integrate embedded banking products into any customer journey, enabling businesses – no matter their sector or specialty – the opportunity to drive revenues through increased conversion, more customer engagement and repeat visits, without needing to build in-house technology or compliance capabilities.

VCP’s architecture and its implications for BaaS adoption are explored in depth in this blog.

Smart contract core banking system: customer-centric, no-code methodology, and high level data security

At the core of VCP’s innovation is its state-of-the-art core banking system designed with a customer-centric approach. The platform employs smart contracts (developer-friendly codes) to allow clients to effortlessly define and automate business processes.

Our approach uses a visual editor coupled with domain-oriented functions to offer partners complete control over product logic, allowing flexibility and innovation in design and development, without the need for programming knowledge.

One of the most remarkable aspects of smart contracts is that they can be used for building and improving any financial product without having to modify the platform’s layer. Partners are empowered to make changes independently, eliminating the need to rely on third-party assistance.

Additionally, we recognise that data security and integrity are paramount to all businesses. To meet this vital need, VCP utilises proprietary blockchain algorithms, guaranteeing the highest level of data security and integrity for our partners.

Our technology guarantees data integrity and nonrepudiation, bolstering the security and credibility of all recorded actions, meaning all transactions and sensitive financial information are in safe hands, ensuring ultimate protection for both clients and their end customers.

Seamless payment engine and real-time foreign exchange (FX) capabilities

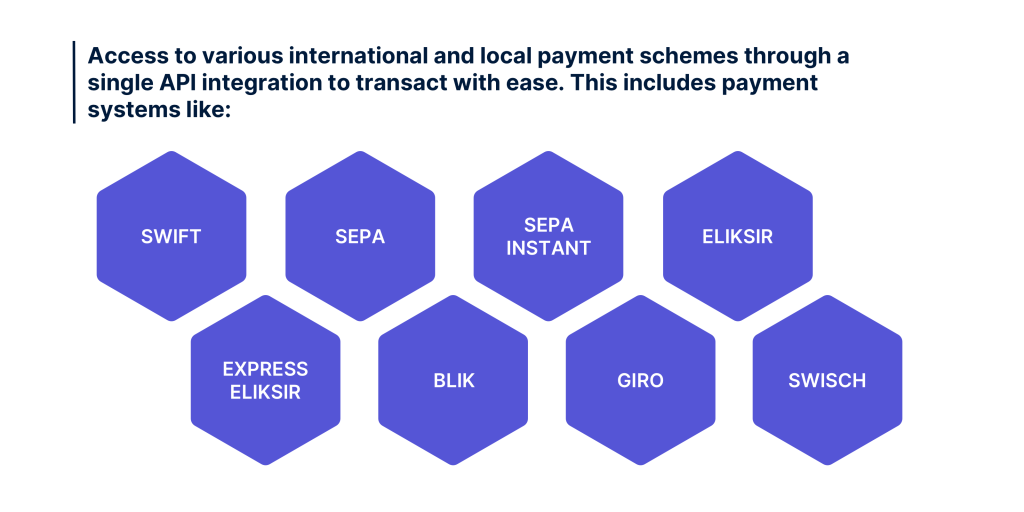

Our proprietary payment gateway solution offers clients access to various international and local payment schemes through a single API integration so that end users can transact with ease, no matter where they are in the world.

This includes payment systems like:

- SWIFT

- SEPA

- SEPA INSTANT

- ELIKSIR

- EXPRESS ELIKSIR

- BLIK

- GIRO

- SWISCH

- And more

Dynamic routing tables enable partners to select the most efficient and cost-effective routes for transactions.

VCP also offers both convenience and cost efficiency with real-time foreign exchange (FX) capabilities for card and payment transactions.

Efficient card system

VCP offers a seamless and efficient card system, developed in partnership with Mastercard. This system simplifies the entire lifecycle of card management and transaction processing.

Whether you’re a neobank, fintech startup, or established financial institution, VCP provides an intuitive interface for quick and hassle-free card issuance. You can effortlessly design, customize, and issue debit and prepaid Mastercards to your customers.

With comprehensive card management tools, clients have access to efficient monitoring of transactions, setting card limits, and responding swiftly to customer requests.

The platform ensures that every card transaction, from online purchases to ATM withdrawals, is processed with the highest level of security. This partnership with Mastercard guarantees your customers’ trust in the security of their transactions and data.

Streamlined onboarding

VCP streamlines onboarding through an internally developed, intuitive process management solution, supplemented by services from leading providers like Onfido and IDNow.

This solution accelerates user and company onboarding based on different documentation sources from the European Union, as well as passports from around the world. Our platform efficiently verifies identities, delivering an intuitive and swift onboarding journey.

Tailored lending

Customisable credit processes and risk assessments ensure efficient and effective lending operations. VCP offers effortless access to local credit databases in Poland, Germany, Belgium and Sweden.

Additionally, lending services are flexible in order to align with the target market and risk appetite for each client.

Fully compliant with scalable architecture

Everything we offer is rooted in a rigorous governance framework, embedding compliance controls at the core architecture.

This structure is further validated by ISO 27001 and 27017 certifications, assuring partners of the highest standards of data security and regulatory adherence. Additionally, with the Google Cloud Platform as its backbone and built on Kubernetes, VCP boasts a scalable architecture that automates resource scaling.

Partners are able to effortlessly accommodate fluctuating demand, ensuring seamless performance even during periods of high usage.

Experience the future of banking with Vodeno

At Vodeno, we have a strong commitment to technical excellence, and our BaaS solution goes far beyond our tech stack alone.

Our team of nearly 100 certified cloud engineers are experts in their field, and on hand to help unlock the complexities of cloud-based banking – everything from security and compliance to data management and application development.

VCP is built to enable a comprehensive suite of BaaS products to both businesses and multiple banks across many countries, delivering unparalleled performance, reliability and scalability.

Get in touch today to learn more about VCP and how it can support your growth.