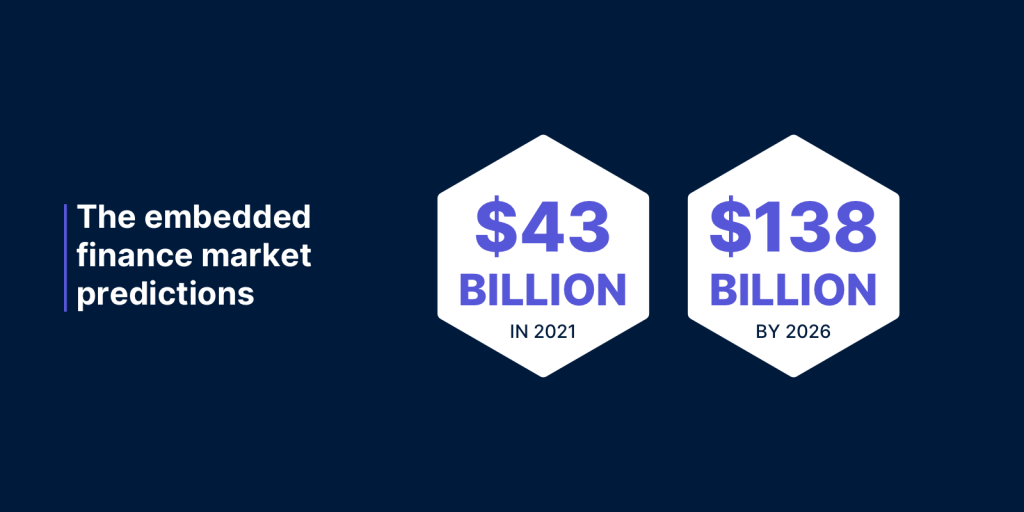

Embedded Finance or Banking-as-a-Service (BaaS) is consistently named as one of the big trends of 2022. Analysts predict that the embedded finance market will be worth over $138 billion by 2026, from just $43 billion in 2021. But, what is embedded finance and why will it see exponential growth across the next three years and beyond?

BaaS offers brands the ability to embed financial services directly into their ecosystem giving them the opportunity to create new commercial opportunities, optimise their customer journey and enter new markets. When we launched Vodeno in 2018, there were many factors impacting the European banking sector that served as the foundation for BaaS innovation, particularly regulation supporting Open Banking (PSD II and GDPR) and the continued adoption of digital financial services.

The concept for Vodeno was to build a financial services technology company with the latest cloud technologies. A fully cloud-native banking platform did not exist at the time, so we built the VODENO Cloud Platform (VCP) from the ground up with proprietary software that covers all aspects of Retail and SME banking via hundreds of open APIs.

We also knew that we needed to tap into fast-moving fintech innovation, so VCP is also a ‘360’ ecosystem with nearly 90 of the best fintechs integrated into the platform.

VCP was first used to transform Banca Monte Paschi Belgio into the fully digital, mobile-first Aion Bank. With the cloud infrastructure of our platform, we were able to complete the project in five months instead of the traditional 18 – 24 month timeline. This laid the foundation of a partnership with Aion Bank to offer a BaaS solution which is second to none in terms of range and reach.

The combination of Vodeno’s fully API-based, cloud-native platform and access to a European banking licence through Aion Bank make us uniquely positioned to offer BaaS to both regulated and non regulated entities across multiple sectors.

We can cover the full spectrum of banking services, from ‘smart contract enabled’ core banking to accounts to payments to lending and investments, and both for retail and corporate end users, allowing for our solutions to be flexible and modular to client needs.

We currently have a multitude of clients on our books and are scaling fast across Europe. From providing lending-as-a-service to e-commerce giant Allegro and servicing accounts for a leading financial superapp in Poland, to supporting multiple German fintechs and one of the largest retailers in the world, our relatively short history has already been dotted with some impressive milestones.

Today, we see tremendous interest from non-regulated companies, who are looking to embed financial products to keep up with competitors and grow their business. With this momentum, our ambition is to become one of the top BaaS providers in Europe across the next three years.

Powering financial services for every business

So, what sets us apart from our competitors?

Unlike many of our competitors, we can provide access to a full European banking licence, which puts us in the ideal position to help fintechs, retailers and brands create embedded financial solutions. We offer regulatory expertise to help guide our clients and ensure their services are fully compliant.

Our ability to offer the back-office compliance and security of an ECB-licensed bank combined with our innovative technology allows our clients to solely focus on servicing their customers.

For retailers and ecommerce companies. building financial services into their offering in order to deliver a seamless checkout experience is critical. Retailers, ecommerce brands, travel companies – there are many examples of businesses in non-banking sectors that can reap the rewards of integrating banking, lending or payment products directly into their ecosystem.

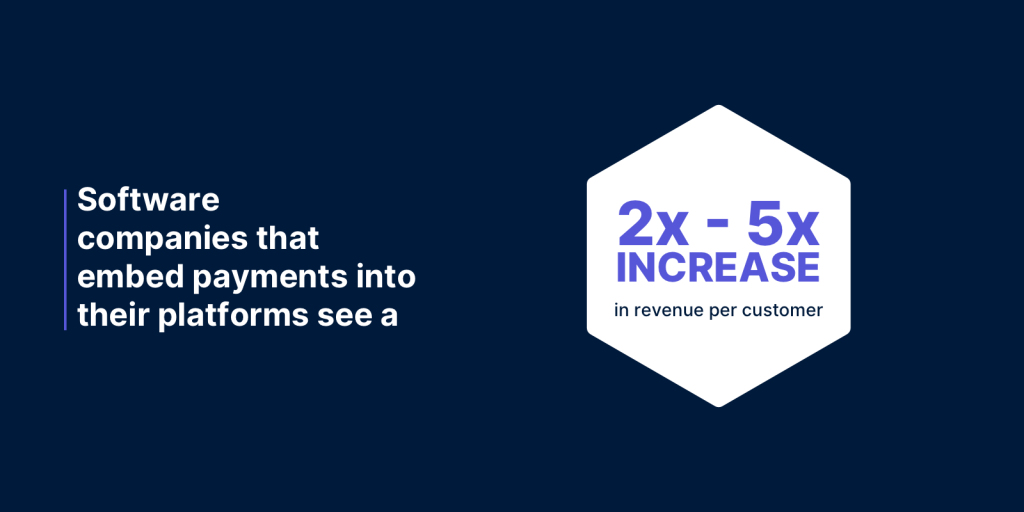

Smart brands understand the value of embedded banking. According to research from J.P. Morgan, software companies that embed payments into their platforms see a 2- to 5-time increase in revenue per customer. For consumers, a seamless checkout experience – one that does not require them to register or enter personal details, and be able to remain on the brand’s website – is the perfect customer journey, leading to more purchases and increased visits.

Additionally, cybersecurity, fighting fraud and financial crime are the core of our solutions. Like any other financial service, embedded financial services are all about trust and security. Customers rightfully do not accept any compromise on safety and societal responsibilities from financial service providers, and we help our partners meet these expectations.

Bringing banking to underserved communities

For individuals or groups with limited access to banking products, we are also creating opportunities to create tailored financial services.

Through our partnership with Talenthouse, the global platform for creatives, we are helping to give this community access to better financial services. Talenthouse recently launched its new banking service, called ElloU, which is designed with creatives – primarily freelancers and consultants – in mind. ElloU removes friction and fees and speeds up payments for invoices, key problem areas many working creatives face. You can read more about this exciting partnership here.

Unlocking the creator economy is just the beginning; we look forward to sharing many more inspiring stories about how our clients are leveraging embedded banking to solve the unique challenges of their customer bases – and, ultimately, better meet their everyday needs.

Let’s stay connected!

Vodeno’s BaaS journey is rapidly growing; we are excited to expand our network of clients and partners throughout 2022 and beyond.

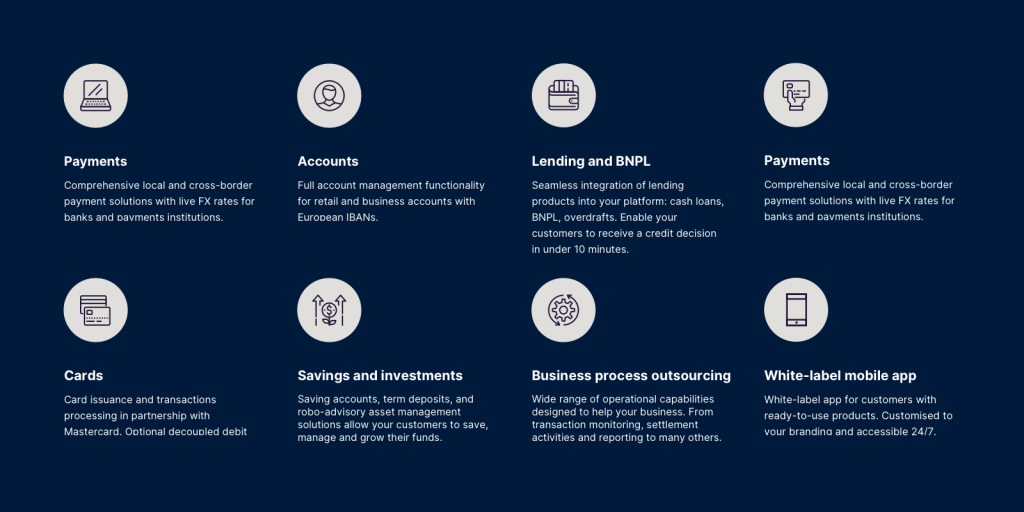

Our comprehensive portfolio of products covers all Retail and SME banking needs:

- Accounts: full account functionalities for retail and business, accessible through both mobile and web channels.

- Payments: end-to-end payment process platforms that cover card payments, SEPA transfers and instant payments.

- FX: in-house FX engines that feature best-in-class technology, interbank rates and direct access to liquidity and risk management.

- Investments-as-a-Service: turn key, white-labelled ETF investment solutions.

- Cards-as-a-Service: white-labelled one-stop solutions for card issuance and processing, for example in partnership with Mastercard.

- Lending-as-a-Service: fully digital end-to-end lending processes. Buy-now-pay-later (BNPL), merchant financing and decoupled debit can also be available as comprehensive end-to-end solutions. The fully digital lending experience is coupled with the flexibility and compliance for any brand or fintech to implement a suite of lending services.

If you would like to follow our journey, then please check out our Twitter and LinkedIn pages.

Reach out directly if you’re looking for a technology vendor who can help empower your business.