The topic of payment innovation is one of the biggest trends dominating the financial news. As commerce shifts further and further from physical cash, cashless solutions are growing both in number and variety, with global cashless payment volumes set to almost triple by 2030.

The pandemic accelerated the use of cashless and contactless payments, creating even more impetus for businesses to ensure they offer a frictionless payment experience for their customers.

The resulting payments boom has seen digital payments being the de facto standard for virtually every business that handles transactions.

The face of payments is vastly different today than it was five years ago, and there is nothing to suggest that it will still look the same in the next five years.

As the industry continues to grow and change, with major advancements predicted in the coming years, we offer our insight to the new shifts within the space, and what businesses can do to remain abreast of these changes.

Speed is of the essence

Settlement time is a key factor in providing a superior modern payments experience to clients, and while instant transfers for low volumes are more common domestically, a major focus in the near future will be on shortening settlement times for higher volume, international transfers.

For years, SWIFT has been one of the best-known, most widely used global banking rails, for international transfers. Its settlement times, however, will not meet industry standards for long.

Three to five days to settle a single transfer will soon be a thing of the past, and as payment partners begin to take advantage of more specialised payment rails and better-interconnected networks, the time and cost required for high-volume international transfers could decrease dramatically.

Faster settlement times are more than just a matter of user convenience – for SMEs, the near-instant settlement will mean increased stability and flexibility of cash flow, making international expansion easier and less risky.

Better access to and support of different payment rails can also have a profound impact on foreign exchange (FX) costs, allowing smaller players to reduce costs and expand into different markets.

Two major concerns of today’s payments space

Two major concerns of today’s payments space are fraud and money laundering. As new payment innovations enter the market, so too do bad actors, so the assurance of safe settlement on all transactions will be a major feature in the future of payments.

While massive progress is currently being made in comprehensive Anti-Money Laundering (AML) technologies, like the one found in Vodeno’s payment solutions, in the future, we will see blockchain further disrupt the way we secure and speed up transactions.

We will see biometric authorisation, machine learning and Artificial Intelligence (AI) play a greater role in the future of payment security – after Visa claimed their digital infrastructure is attacked two million times every day, they invested heavily in real-time AI that monitors for financial crimes.

As financial criminals get smarter, these security advances will work to stay one step ahead.

Understanding the payments landscape: our latest research.

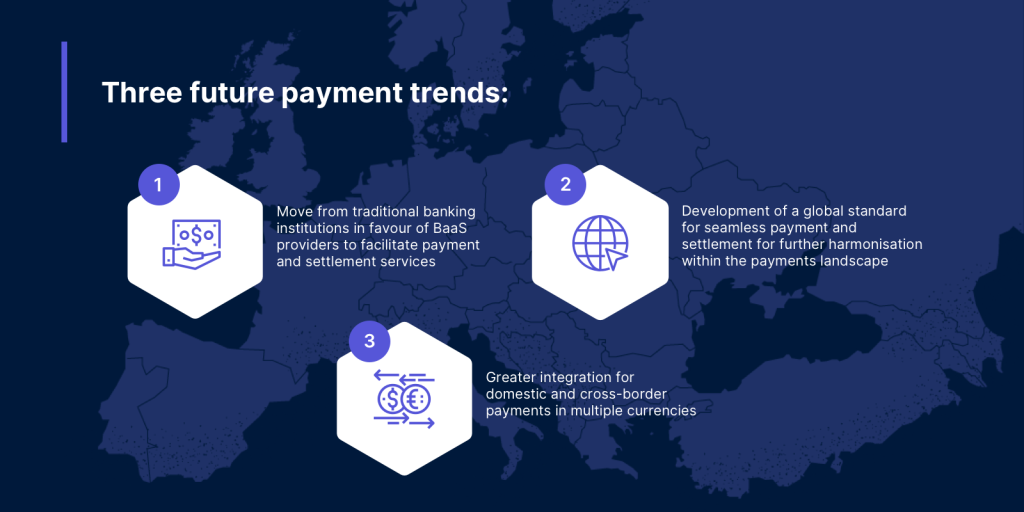

Three Payment trends

While the potential of payments in the future seems limitless, these innovations come with their own risks and setbacks.

The most important factor for a business to consider when selecting a payments solution is to know that their partner has the infrastructure, experience and regulatory knowledge to predict, plan for and help navigate the coming changes.

- In the near future, we expect to see businesses moving away from traditional banking institutions to facilitate their payment and settlement services in favour of BaaS providers like Vodeno.

- Another key trend to watch out for is greater integration for domestic and cross-border payments in multiple currencies, in a similar vein to the P27 initiative in the Nordic region.

- We are likely to see further harmonisation within the payments landscape, with the development of a global standard for seamless payment and settlement.

With a single API solution that automatically chooses the best payment rail for each transaction, including access to Eurozone and local rails, powerful AML and anti-fraud capability, interbank FX rates and six-second settlement times, Vodeno is the right choice for any growing or established business in need of a payment partner.