The Banking-as-a-Service (BaaS) opportunity is clear: embedded finance solutions can offer tangible benefits across multiple sectors to improve user experience (UX), drive increased revenues and create deeper relationships with customers.

In our survey of over 1,000 business leaders in the UK, Belgium and the Netherlands, more than half (51%) believe that, in the near future, consumers will choose to engage with financial products and various financial services offered directly by the brands they know and use every day, more than traditional branch-based banking products in the banking industry and BaaS services.

However, for brands that are considering working with a Banking-as-a-Service (BaaS) provider for BaaS platform, licensing is an important part of the puzzle; ensuring that your BaaS services partner has the right banking licence that will enable the products you want to offer is fundamental when choosing a provider.

For 58% of the businesses we surveyed, BaaS providers of a BaaS platform with a banking licence alongside their tech solution are expected to shape the BaaS market in the years to come – but what does this mean? Here, we explain the differences between banking and non-banking licences and why you might choose one over the other.

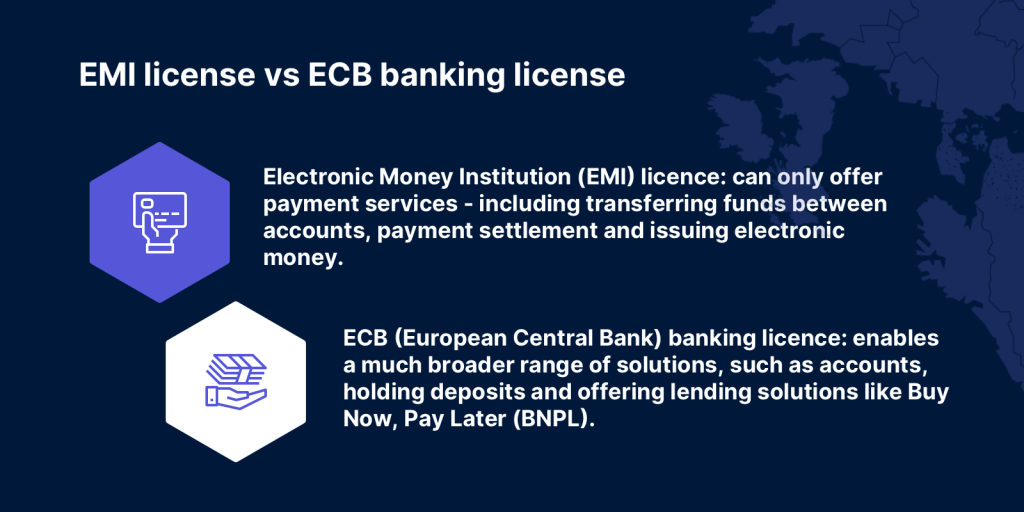

EMI vs. ECB licences

The type of licence held by the Banking-as-a-Service (BaaS) provider determines the types of products and services they can offer on their service platforms.

For example, a provider with access to an Electronic Money Institution (EMI) licence can only offer payment processing services to its clients – this includes transferring funds between accounts, payment settlement and issuing electronic money.

Alternatively, Banking-as-a-Service (BaaS) providers with an ECB (European Central Bank) banking licence enables a much broader range of solutions, such as accounts, holding deposits and offering lending solutions like Buy Now, Pay Later (BNPL).

What the right licence can do

Our partnership with leading global wholesaler in the hotel, restaurant and catering (HoReCa) industry, METRO AG, underscores how a BaaS provider with access to a full banking licence helped to create an innovative product that was built to solve the specific pain points of their customer. Businesses in the hospitality industry face cash flow issues when needing to pay upfront for goods, with payback happening at a later date. To solve this challenge, METRO Financial Services launched an innovative decoupled debit card that provides its customers with flexible lending options and up to 1% cashback. The card also links to the user’s current account of choice, removing the need to open a new account or top-up funds to the card.

Providing this solution in the background, Vodeno’s platform uses PSD2/open banking standards, enabling the METRO FS app to check a customer’s bank balance with their existing bank four times per day to confirm that funds are available for purchases. Additionally, with access to an ECB licence via Aion Bank, METRO FS grants a credit line to customers during the onboarding process – post-purchase, customers can make the most of the Buy Now, Pay Later functionality integrated into the debit card to defer payment for up to 60 days, or pay in up to 48 monthly instalments.

Although there is a lot going on behind the scenes, all customers see is an elegant product at the front end that meets their specific needs – without access to a full banking licence, this product wouldn’t be possible.

Choosing the right provider for the right services

Strong API-based technology is table stakes amongst the best Banking-as-a-Service (BaaS) providers, with financial technology developing and digital banks developing, however, few provide access to a full banking licence that can enable a full scope of financial products and financial services including lending.

Vodeno and Aion are one of the few BaaS providers and payment services providers in Europe to offer a comprehensive set of products enabled by a ECB banking licence, including; accounts, cards payments, FX,and lending, as complete end-to-end digital banking services.

Get in touch today to see how we can help you.