Retailers blazed the embedded finance trail in 2021. Early adopters quickly implemented split payment options at checkout at the behest of their customers, while others started looking further afield to products like branded debit cards to win customer loyalty.

Yet, as with all megatrends, the devil is in the details – why are retailers jumping on the trend, how does the customer benefit, and what do brands hope to achieve by leveraging embedded banking?

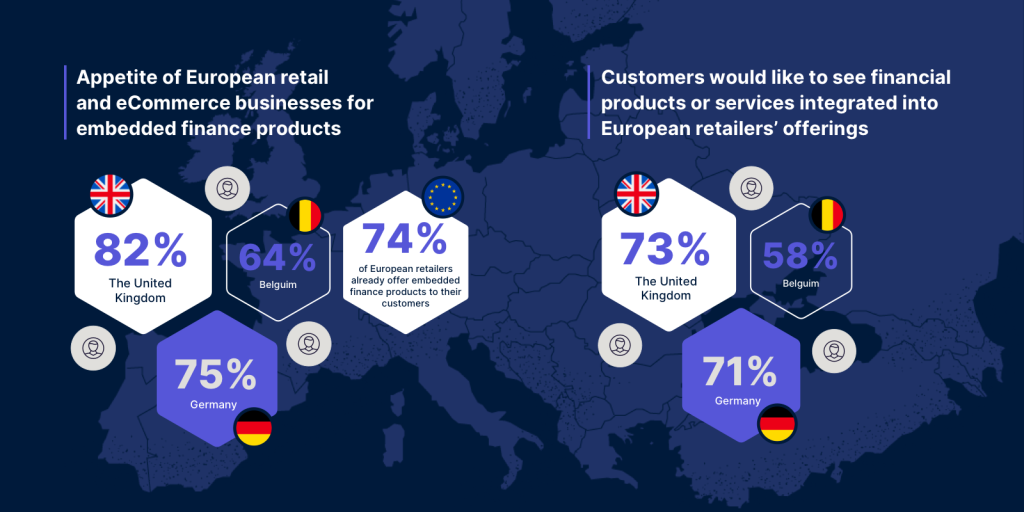

Our recent survey of more than 750 decision-makers from retailing and eCommerce companies in the UK, Germany and Belgium has granted us greater insight into the thoughts and attitudes of the sector as a whole.

Embedded finance – why now?

Embracing embedded finance has proven to be a popular strategy in 2022 – of those surveyed, 56% of retailers have already made plans to launch new embedded finance products as part of their offering in the coming year. That more than half of businesses have made this decision is telling – embedded finance is no longer just the reserve of large players with deep pockets.

This shift was likely spurred by the increased demand for embedded banking and payment solutions that resulted from the pandemic. Customer expectation for smooth, seamless purchasing journeys has been set higher than ever before, and retailers have figured out that they need to step up.

This demand was evident within the survey, where 67% of respondent businesses said that in 2021, their customers had indicated that they would like to see financial products or services integrated in their platforms. This figure was highest in the UK where it rose to 73%, as opposed to 71% in Germany and 58% in Belgium.

What is motivating retailers to invest in embedded banking solutions?

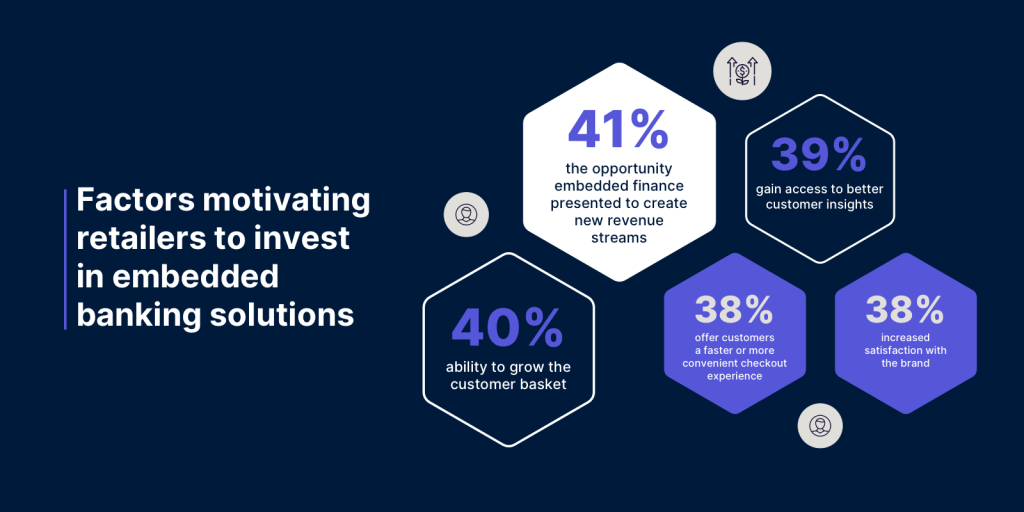

While responding to customers’ expectations was likely a principal motivator in the move towards embedded finance, we also examined the other factors that had influenced retailers in that direction.

The most popular motivating factor among respondents was the opportunity embedded finance presented to create new revenue streams, with 41% of those surveyed identifying this as a key opportunity. A further 40% chose its ability to grow the customer basket.

In an industry that often operates on fine margins, products like Buy Now, Pay Later are an appealing prospect as they enable consumers to increase their spending power and entice them to purchase more goods.

39% of those surveyed stated that they were motivated to offer embedded finance in order to gain access to better customer insights, putting user analysis and personalised experience as priorities for their business.

38% viewed embedded finance as a means of offering their customers a faster or more convenient checkout experience, and the same proportion of respondents named “increased satisfaction with the brand” among their key motivating factors.

Retailers rapidly embracing the embedded finance model

The results of our research paint a clear picture of the retail industry rapidly embracing the embedded finance model as a whole, while also providing a better idea of the reasons for this shift. Nothing is more important to retailers than their customers.

For many of them, the move to embrace embedded finance is motivated by the desire to engage more meaningfully with their client bases, provide them with better tools and experiences and build stronger, longer-lasting bonds.

Increasing sales and revenues, generating more valuable data about consumer preferences and spending habits and deepening relationships with new and existing customers is a monumental task, but with Banking-as-a-Service (BaaS), the technology and access to the necessary licence and regulatory requirements are within reach.

Read more on building Vodeno into a top European BaaS Player.

With the right BaaS partner, enacting such transformative changes to a business’ operations is not only accessible but also cost effective – the next evolution of retail is here, so don’t be left behind.