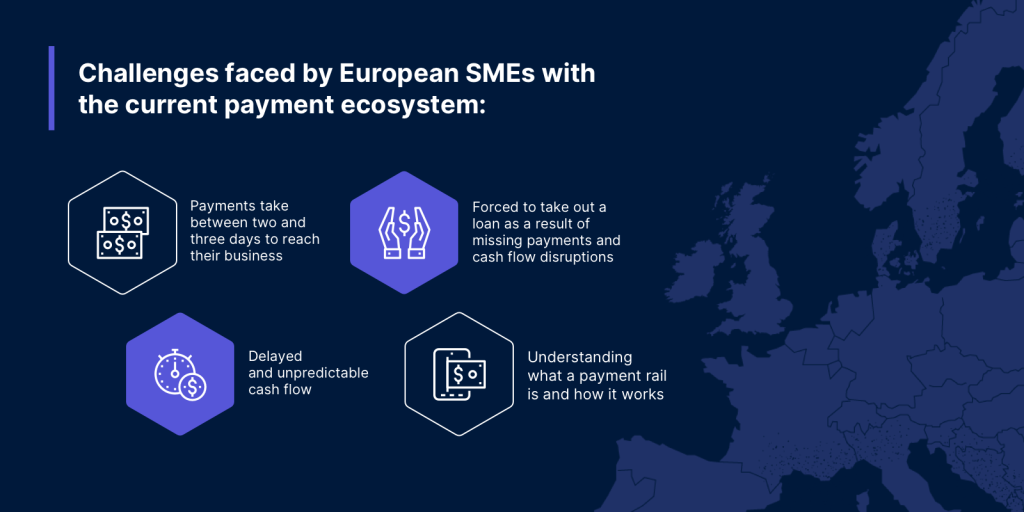

A new independent survey of more than 2,000 senior decision-makers from European SMEs reveals the challenges faced by the current payment ecosystem.

It found:

- On average, 35% claimed that payments take between two and three days to reach their business

- 54% have been forced to take out a loan as a result of missing payments and cash flow disruptions

- 62% contend that delayed and unpredictable cash flow is the biggest challenge their business currently faces

- Overall, only 37% understand what a payment rail is and how it works

- The vast majority (68%) plan to adopt real-time payment processing capabilities in the next 12 months

European small and medium enterprises (SMEs) are suffering from significant payment issues, but lack a thorough understanding of the processes involved, new research from Banking-as-a-Service (BaaS) provider Vodeno has revealed.

The company commissioned an independent survey among more than 2,000 senior decision-makers in SMEs across the UK (504), Belgium (500), France (500) and the Netherlands (500).

It found that just 37% of those surveyed understand what a payment rail is and how it works.

International payments

When quizzed about the amount of time taken for international payments to be processed and reach their business, only 10% said that payments are processed instantly, while 11% said that the process happens within the hour.

On average, the highest number of respondents across all territories (35%) said that international payments take between two and three days to reach their business.

At a granular level, this was the case for 59% of Belgian SMEs surveyed, 30% in France, 25% in the UK and 19% of those in the Netherlands, respectively.

Read more about the future of payments.

Take out a loan as a result of missing payments

More than half (52%) of the SMEs surveyed claimed that they have failed to meet commitments due to slow payment processing, while even higher numbers (54%) stated that their company has been forced to take out a loan as a result of missing payments that caused a disruption to cash flow.

According to the research, the majority (62%) reported that delayed and unpredictable cash flow was the biggest challenge their business currently faces, while the same number said that costly foreign exchange (FX) and exchange rate fluctuations contribute to a significant drain on their resources.

Looking ahead, the vast majority (68%) intend to adopt real-time payment processing capabilities in the next 12 months.

You can learn more about the research: Understanding the payments landscape.

Tom Bentley, CCO of Vodeno, said:

“Long settlement times, delayed transactions and a lack of transparency in the payments space can cause headaches for businesses – particularly small and medium enterprises (SMEs) who typically have fewer reserves to draw upon when disruptions occur. Our research shows that these organisations rank missing payments amongst their most significant challenges, with many taking drastic measures to stay afloat.

“In the current macroeconomic climate, cash flow can mean the difference between survival and insolvency, and unpredictable payment processing is the single biggest disruption to business operations. Banking-as-a-Service (BaaS) offers new innovations, better solutions and the ability to make real-time payments a reality for more businesses.“

“At Vodeno, our technology automatically identifies the most appropriate payment rail for any given transaction, offering cost effective and fastest settlement for our clients.”