For retailers of all sizes, the ability to catch a customer’s attention, gain their trust and ultimately win their loyalty has always been paramount to building a sustainable, profitable enterprise. This was brought into sharp focus during the Covid-19 pandemic, as consumer expectations for seamless online retail experiences were raised.

This goal of creating easy and frictionless customer journeys has led more and more retailers to integrate embedded financial solutions into their ecosystems, with vendors large and small offering digital wallets, branded cards, and credit products.

The most visible of these products in the media today is Buy Now Pay Later – a hugely popular split-payment lending product that divides the total cost of purchase into multiple monthly installments over a fixed period, creating an easily accessible and appealing solution to consumers with limited short-term spending power.

Retailers who offer Buy Now Pay Later (BNPL)

Offering embedded finance products at checkout provides many benefits to non-financial businesses like retailers – they can increase conversion and size of shopping basket. Retailers who offer Buy Now Pay Later (BNPL), for example, can expect a 20-30% increase in conversion.

When brands can keep their customers completely in their ecosystem through checkout they can also generate valuable user data and provide insights into customers’ spending habits. Armed with these insights, businesses can launch new commercial models, bolster revenue streams and ultimately deliver products and services that their customers want to see.

While the initial popularity of Buy Now Pay Later products was driven by the profile and visibility of a handful of prominent fintechs, the importance of seamless, end-to-end customer experiences has inspired many retailers to reclaim the integrity of their purchasing journeys by offering embedded financial products of their own.

BaaS has unlocked opportunities for brands

While the third-party financial solutions offered by those first generation Buy Now Pay Later giants appealed to retailers in 2021, Banking-as-a-Service (BaaS) has unlocked opportunities for brands to directly offer these products, therefore maintaining control of their customer and improving their overall shopping experience.

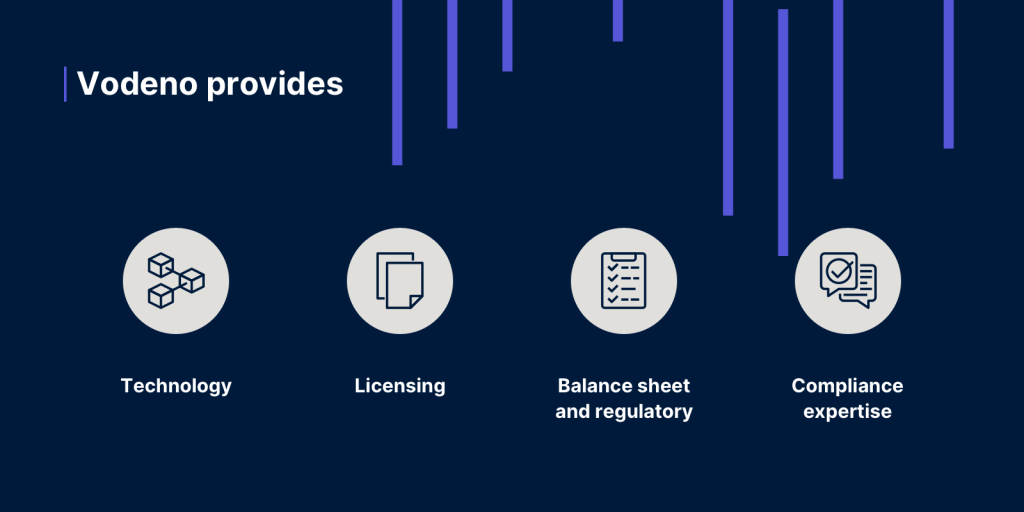

This is the promise we offer our clients. By providing the necessary technology, licence, balance sheet and regulatory and compliance expertise, our white-labelled embedded products can be quickly and easily integrated into any brand’s ecosystem.

At a time when mounting consumer expectations are making embedded finance table stakes for today’s retailers, the beauty of BaaS products is that our partners do not need to understand the ins and outs of financial services – they can simply rely on us to deliver best-in-class products with comprehensive functionality and in full compliance as one of the BNPL providers.

Read more about building Vodeno into a top European BaaS Player.

In a competitive market for retailers, where novel solutions like Buy Now Pay Later are now an expectation, having the right BaaS partner in a world where there are many BNPL providers is critical to make the most of the embedded finance opportunity.