Banking-as-a-Service (BaaS) creates value and opportunity for both financial and non-financial businesses. For banks, BaaS provides the ability to leverage API-based technology to quickly embed banking products into client ecosystems. For brands, seamlessly integrated financial products that meet customers at the point of need are driving conversion and revenue, as well as enhancing loyalty and retention.

The key to effectively leveraging BaaS is to understand what it can (and cannot) do for your business. It is equally important to appreciate the key differences between the many types of providers that make up the BaaS landscape. In this article, we demystify some areas of confusion surrounding BaaS.

What is Banking as a Service?

Deloitte defines Banking as a Service as the provision of banking products and services – retail or corporate – through third-party distributors. Leveraging modern, API-based platforms with regulated financial infrastructure, BaaS offerings enable new, specialised propositions and bring them to market faster. Players in the industry align to one of four main configurations:

- Providers provide their banking licence, products, operations and/or technology for use by aggregators, other banks and non-financial companies (NFCs)

- Providers-Aggregators act like providers, but also couple their own capabilities with other vendors to compose a complete “out-of-the-box” solution

- Distributors leverage end-customer relationships to offer unique financial services propositions

- Distributor-Aggregators enhance the propositions they distribute by adding new products or technology from multiple providers

Why is Banking as a Service important?

BaaS enables any brand to offer financial products directly to their customers, giving greater choice through the access to quality banking products while also helping to drive conversion and engagement. Meanwhile, licensed banks and other financial institutions are leveraging BaaS to speed the time to market of new banking products and services. According to our research, 64% of decision-makers believe that BaaS will achieve mainstream adoption in the next five years – meaning that it will have a significant impact on the banking industry as we know it.

Who benefits from Banking as a Service?

Both the companies adopting BaaS and their end customers benefit. Brands that embed value-adding financial services into their ecosystems help to solve key customers’ pain points. Simply put: embedding financial services leads to a smoother customer journey and a better, more frictionless experience, while the availability of financial products offered in a contextual way (at the point of need) offers greater choice and flexibility.

For a financial institution such as a bank, this platform provides a way to offer their services to more users via a Business to Business to Consumer (B2B2C) model, as the traditional banking customer acquisition becomes stressed.

Now, let’s challenge some myths about Banking as a Service.

Myth 1: Banking as a Service and embedded banking are one and the same

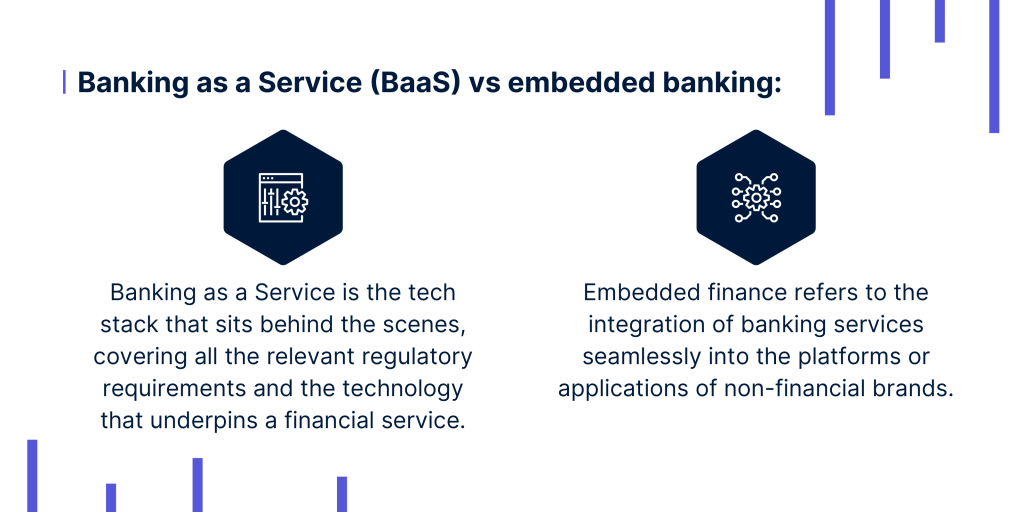

BaaS and embedded banking services are closely related, but they are not the same.

Banking as a Service is the tech stack that sits behind the scenes, covering all the relevant regulatory requirements and the technology that underpins a financial service.

Embedded finance refers to the integration of banking services seamlessly into the platforms or applications of non-financial brands, allowing customers to access banking products within the context of their daily activities, at the very point in the customer journey where they need them. BaaS providers that combine API-based technology and the necessary banking licence can enable a comprehensive suite of embedded financial services, including payments, accounts, lending solutions, etc.

Read more about the differences between BaaS vs embedded banking.

Myth 2: All Banking as a Service providers’ tech stacks are the same

Not every BaaS provider is created equal, and as such, providers vary significantly in terms of their technological capabilities and services offered.

While some entities specialise in particular segments or functionalities, such as faster payments, others are equipped with the APIs to offer a full-stack financial services, from lending and white-label banking and card issuing, to embedded lending and savings accounts and investment services.

For example, Vodeno’s proprietary core banking system is unique in that it is designed with a customer-centric approach, utilising smart contracts and proprietary blockchain algorithms. This enables partners to automate their business processes effortlessly using no-code methodology, accelerating their time to market while ensuring the highest level of protection for sensitive financial data.

Myth 3: All Banking as a Service providers are licensed in the same way

One of the most important distinctions between BaaS providers is licensing.

All BaaS providers must have the API-based platform and core banking infrastructure necessary to provision financial products and services, but all providers are not always licensed in the same way. Some have access to an Electronic Money Institution (EMI) licence, which enables payment processing solutions – transferring funds between bank accounts, payment settlement and issuing electronic money – but cannot provide services such as holding deposits and lending. Alternatively, some providers offer services based on a full banking licence, which allows for a comprehensive suite of banking products and services, in addition to the compliance and regulatory requirements that come as part of a fully licensed bank.

Read more about banking licences here.

Myth 4: Banking as a Service adopters don’t need to worry about compliance

Today, the greatest BaaS adoption is taking place amongst non-financial brands, like retailers and eCommerce marketplaces. These businesses are not experts in financial services, and many do not have regulatory and compliance support in-house. It’s important for adopters to be aware that not all providers offer a full end-to-end service, covering the financial technology, licensing and compliance and risk management required to bring financial products to market.

Partnering with a service provider who can take full accountability for compliance and banking back-office functions like AML and KYC is essential to avoid issues. Without the right level of support, Banking as a Service platform adopters may find themselves underserviced, which means that they may have to outsource compliance responsibilities to another banking services provider or hire a dedicated team to handle compliance in-house. Ultimately, this can lead to added costs and delays in launching financial services to market, as well as further complications when it comes to managing relationships with different regulatory authorities.

Find out about the 5 things BaaS adopters need to know about regulatory compliance.

Myth 5: BaaS is only about payment solutions

While payments are the foundation of BaaS, providers with a full banking licence can offer a full suite of banking products and services. For example, embedded lending has become popular with many BaaS adopters, as solutions like Buy Now, Pay Later (BNPL) have proven to increase conversion and customer loyalty. In fact, the global BNPL market was valued at $309.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 25.5% between now and 2026.

Far beyond the remit of payments, our research has revealed that BaaS adopters are weighing up a wide variety of different products, with FX (48%), BNPL (48%), SME lending (47%), and loyalty (46%) are amongst the most popular products planned for implementation in 2023 and beyond.

Read more about BaaS lending here.

Myth 6: Banking as a Service only has Business to Consumer (B2C) applications

While initial BaaS use cases have focused on B2C, there is a huge opportunity for BaaS with SMEs. Increasingly, small businesses are offering banking services and payments not just to their end customers, but also to their value chains, including vendors, suppliers and intermediaries.

According to research, the B2B eCommerce market is anticipated to exceed $20 trillion globally by 2027, with companies like Uber leading the charge, developing financial services that help drivers buy vehicles, handle payments and extend fuel credit cards. Amazon has followed suit, distributing around $5 billion in loans to SMEs to support their growth, in turn, driving loyalty to the Amazon platform.

Vodeno/Aion offer a product called Merchant Financing – essentially BNPL for SMEs. Marketplaces can offer merchant financing to their vendors, as it gives access to upfront funding to produce, buy and sell goods. The capital that is secured is paid back once goods are sold and profits are realised. SME access to credit can be difficult, but merchant financing empowers SMEs to obtain capital and fully manage their cash flow in line with their turnover.

Find out more about the B2B potential of BaaS solutions here.

Myth 7: Banking as a Service marketing and product marketing strategies are the same

When it comes to marketing new embedded finance services to potential customers, adopters tend to rely on the same strategies and messaging used for product marketing. While many providers fall into the trap of assuming that simply offering the solution will be enough to engage their existing user base, financial services and embedded banking projects require a more specialised approach.

Given that the majority of adopters do not have experience successfully implementing and scaling financial services and products, many require further support from the service provider to help educate customers on the value prop and drive engagement.

Read more about unleashing the power of BaaS.

Myth 8: Consumers will only use banking products from traditional banks

With consumers’ appetite for frictionless financial services on the rise, increasingly, we are seeing that consumers are relying on their favourite brands for their banking needs – not just legacy banks. BaaS adoption is growing in the retail sector, and our research of over 1,000 European decision-makers in the UK, Belgium and the Netherlands has shed light on what this means for traditional banks. The majority of those surveyed (59%) predicted the rise of ‘platform banking’ via brands, with a further 60% anticipating a decline in traditional branch-based banking.

Conclusion

While some fintech trends might come and go, all signs point towards the fact that BaaS will usher in a seismic shift that will change the way we access financial services. The banking services market is expected to reach a value of $7 trillion by 2030, and we will soon see some form of BaaS-enabled embedded finance in virtually every brand we visit. While BaaS is not a simple concept to understand, especially for those new to financial services, by providing information and debunking common misconceptions, we aim to help educate businesses on the potential benefit to both their customers and their bottom line.

As a banking provider that offer banking services, Vodeno can assist you in adopting complete banking services with BaaS.

Arrange a call with a member of the team today to find out more.