In the current global economy, cross-border transactions are surging – and quick.

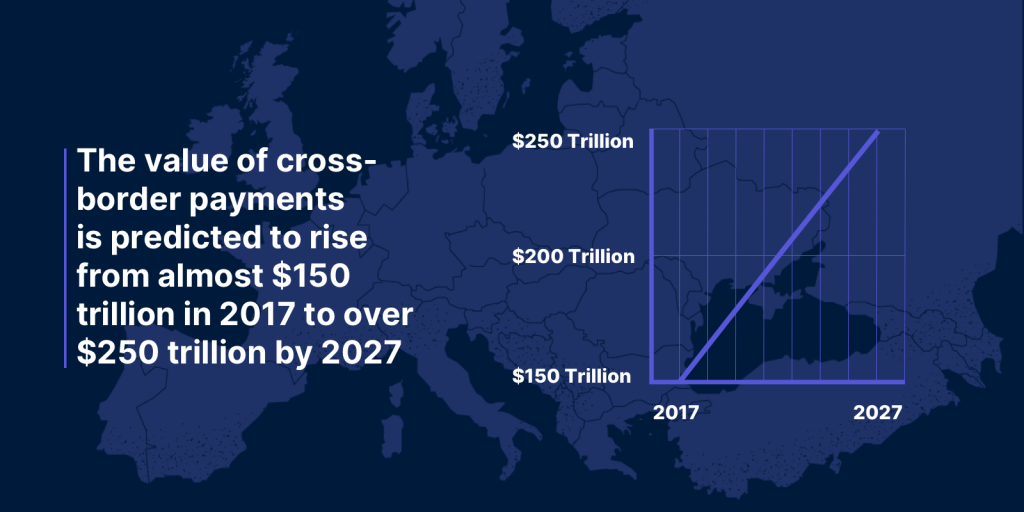

As eCommerce and international trade have gone from strength to strength, the value of cross-border payments and international payments and international transactions is predicted to rise from almost $150 trillion in 2017 to over $250 trillion by 2027, according to modelling from the Bank of England.

This equates to a staggering rise of over $100 trillion in just 10 years for cross-border payments.

Despite the meteoric rise of eCommerce and the huge strides made in the financial services (FS) industry at large in recent years, many financial institutions still struggle when it comes to facilitating quick and seamless international payments and cross-border payments with multiple currencies and bank accounts.

Although technology and offerings like Buy Now, Pay Later (BNPL) have drastically changed the ways in which consumers can access credit to pay for transactions, the cross-border payments infrastructure remains archaic.

Retailer’s very own BNPL: The importance of white-labelling.

In practice, this means high costs, limited transparency and sluggish settlement times, not to mention the added compliance concerns that firms must consider when doing cross-border payments.

That’s why, as competition in the retail space booms, global brands are turning to fintech partners that provide one-stop-shop payment solutions. To set themselves apart from their competitors, these solutions must make cross-border payments quick, secure and transparent for retailers.

With all of the above in mind, we have pulled together a quick guide to some new trends on the horizon in the cross-border payments arena.

All aboard: demystifying payment rails.

APIs mean real-time FX rates

No one organisation will be the same in its scope, offering or speciality. As such, all businesses and retailers transact across a variety of market segments, countries and currencies requiring a different scope for cross-border payment options.

As things stand, a lack of clarity on the costs of spread on foreign exchange (FX) can quickly impact the ability to do business internationally, and this can pose significant obstacles for some firms needing cross-border payments.

This is where Application Programming Interfaces (APIs) are changing the game.

Thanks to open APIs, firms can leverage simple solutions that seamlessly integrate into their pre-existing infrastructure, enabling them to access real-time visibility into FX rates making cross border payments managable.

Crucially, this allows organisations to effectively manage their currency exposure, mitigate risk and speed up the overall payments experience as a result of improved transparency.

Better still, some solutions make it possible for merchants to lock in rates for predetermined periods of time, while senders can view FX rates upfront before completing a purchase.

The end result is that retailers can gain a much clearer picture of their FX costs, and, accordingly, they can price goods in their client’s chosen currency with ease.

At Vodeno, our single API integration automatically chooses the most efficient rail for each payment – including access to local rails when necessary – enabling a much quicker, frictionless payment journey that reduces the cost to send and collect money.

Crystal clear payment status

Another common criticism of existing international payment methods is the lack of transparency at play throughout the process. Importantly, these problems go beyond the combined price of SWIFT messaging fees, regulatory costs and the reimbursement of correspondent banks.

Indeed, many organisations also face significant complications when it comes to the visibility of arrival confirmations and the speed of transactions.

Again, API connectivity comes to your rescue. By leveraging API-first payment platforms, beneficiaries can manage and monitor their payments around the clock, allowing them to keep track of funds and act accordingly to mitigate problems.

Once implemented, platforms with this functionality allow retailers and merchants to focus on doing what they do best – keeping their customers happy and building first-class consumer-centric products.

Finding the best cross-border payment methods for your business

As a European leader in Banking-as-a-Service (BaaS), Vodeno understands the unique challenges that retailers and merchants face when operating cross-border and finding the best cross-border payment solution among all the financial institutions. With our single API integration, we offer local and cross-border payment systems tailored to each client.

As Vodeno we offer a seamless cross border payments platform to transfer funds and are committed to enhance cross border payments, making cross-border payments more secure and transparent than ever for your business.

Cross-border payments efficiency is key to a successful international organisation.

Get in touch with a member of our team today to learn more about how we can support your organisation with our best-in-class cross-border payments option to enhance your payment gateway and payment process. Make cross-border payments work for your organisation!